Audit requirements for Incorporated Associations vary dependent upon the size of the entity. At Integrated Audit Service, we will determine whether your association requires an audit, and if required, conduct the audit so that you meet your audit requirements.

Many not for profit entities are registered with the State based Office of Fair Trading under the Associations Incorporation Act 1981. Also registration under the Collections Act 1966 and the Gaming Machine Act 1991 may be applicable.

Level 1 associations

Where current assets are more than $100,000 or total revenue is more than $100,000 financial statements must be audited.

Level 2 associations

Where current assets are between $20,000 and $100,000 and/or total revenue is between $20,000 and $100,000 financial statements must be reviewed and verified by an auditor or certified accountant. However if Level 2 incorporated associations are also registered under the Collections Act 1966 or the Gaming Machine Act 1991 financial statements must be audited.

Level 3 associations

Where current assets are less than $20,000 and total revenue is less than $20,000 an independent audit or verification is not required but the financial statements must be verified by the president or treasurer. However if Level 3 incorporated associations are also registered under the Collections Act 1966 or the Gaming Machine Act 1991 financial statements must be audited.

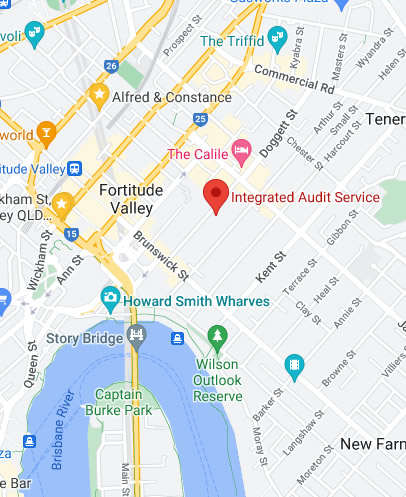

Integrated Audit Service is based in Brisbane, but offer our services to all regions of South East Queensland, and in fact Australia wide. Contact Us with your enquiry, let's get started on your audit today!