Do you think your charity or non-profit organisation might need auditing? At Integrated Audit Service we can determine whether your organisation requires an audit.

These organisations are in most instances either a company limited by guarantee registered with ASIC or an incorporated association registered with the Office of Fair Trading. If the organisation is also a charity it will be registered with the ACNC. After an organisation is registered as a company limited by guarantee with ASIC it may apply to the ACNC to register as a charity. Once registered with the ACNC most of the company’s ongoing obligations are to the ACNC rather than ASIC. If it is an incorporated association and registered charity then reporting and audit requirements may be twofold to both the ACNC and the Office of Fair Trading. The ACNC is currently negotiating with the various States in an attempt to remove these dual reporting requirements. The size of your charity will decide whether or not you require an audit.

Small Charities – Where annual revenue is less than $500,000.00 there is no obligation for a review or audit and no obligation to lodge financial statements with the ACNC.

Medium Charities – Where annual revenue is between $500,000.00 and $3,000,000.00 there is an obligation for a review or audit and for financial statements to be lodged with the ACNC.

Large Charities – Where annual revenue exceeds $3,000,000.00 there as an obligation for an audit and for audited financial statements to be lodged with the ACNC.

Warning – Other legislation may require a review or audit and will over-ride the ACNC audit requirements. Refer to our comments relating to audits of Incorporated Associations and Corporations.

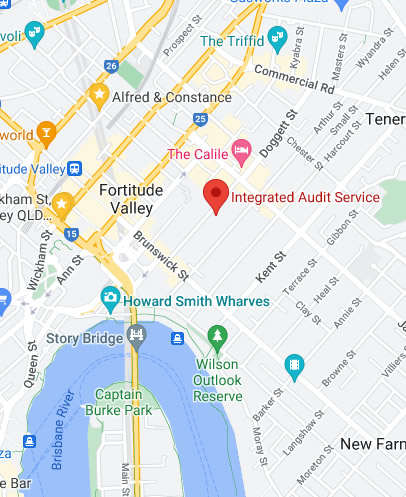

Integrated Audit Service is based in Brisbane, but offer our services to all regions of South East Queensland, and in fact Australia wide. Contact Us with your enquiry, let's get started on your audit today!