At Integrated Audit Service we have years of audit experience and have audited hundreds of trust accounts. Not sure whether your trust account requires an audit? We can determine whether an audit is required, and if so, get the necessary audit underway.

There are various pieces of legislation which require annual audits of trust accounts which fall into three broad categories:

- Office of Fair Trading for real estate agents, auctioneers and debt collectors

- Department of Justice and Attorney General for accountants

- the Queensland Law Society for solicitors

These are not financial audits but are designed to satisfy the compliance requirements for keeping of trust accounts set out in the respective legislation.

Solicitor and Accountant trust account audits are in respect of the period ending on 31 March each year. Our audit report is required to be lodged by 31 May. Licencees with the Office of Fair Trading are required to have an audit of their trust account undertaken for the period ended four months prior to the month of renewal in each year. Our audit report is required to be submitted no later than the end of the licence renewal month in each year.

In addition to the annual reporting requirement licencees with the Office of Fair Trading are also required to have their auditor undertake two unannounced examinations of their trust account during each reporting period.

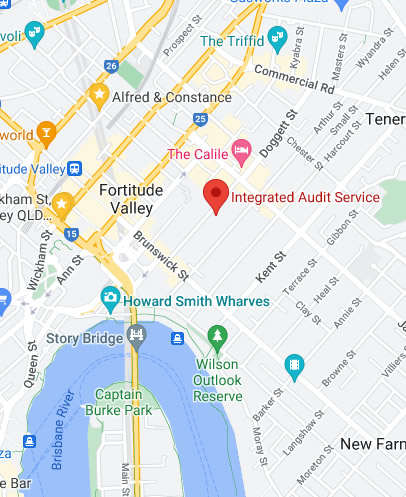

Integrated Audit Service is based in Brisbane, but offer our services to all regions of South East Queensland, and in fact Australia wide. Contact Us with your enquiry, let's get started on your audit today!